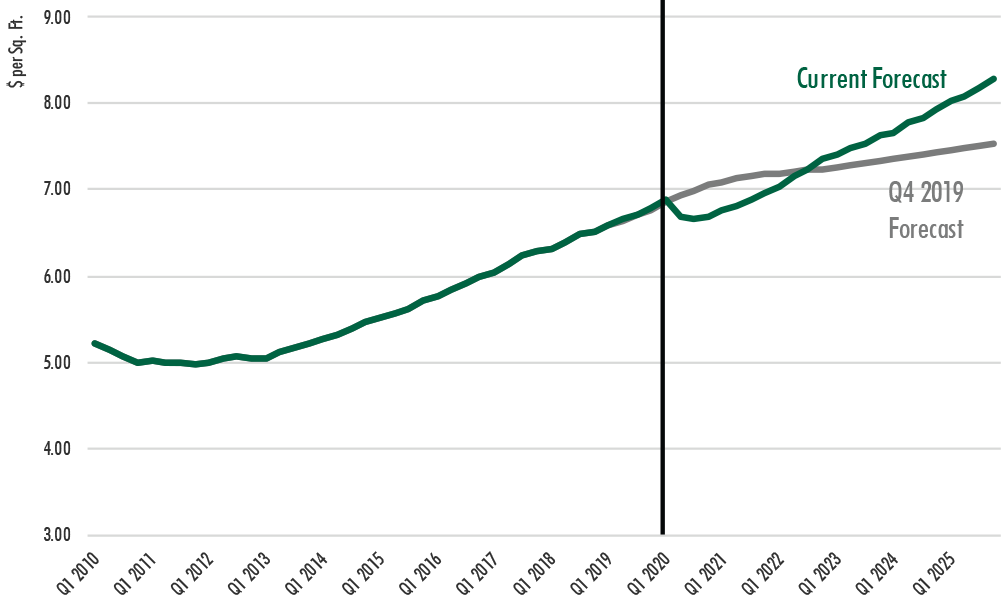

Fueled by e-commerce growth, annual net industrial absorption will total more than 333 million sq. ft. by 2022, leading to annual rent growth of 5.7%, according to the latest CBRE estimates. This is more than triple the previously forecast demand based on new metrics that CBRE Economic Advisors (CBRE EA) has developed using e-commerce data.

In the COVID-19 era, e-commerce is fueling industrial demand more than ever, so basing forecasts solely on traditional employment-based metrics is no longer enough. By incorporating e-commerce data into its industrial forecasting models beginning in Q1 2020, CBRE EA is now able to more precisely forecast industrial rent, availability, absorption and construction.

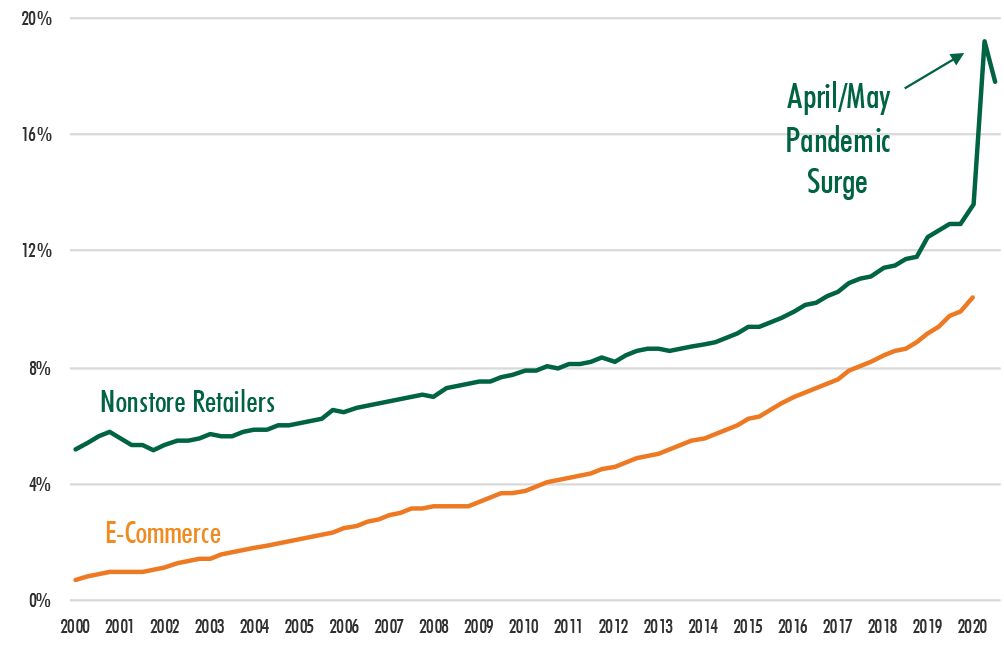

The COVID-19 pandemic has resulted in significant gains in e-commerce’s share of total retail sales, which should further stimulate industrial demand and provide a short-term buffer to a more severe economic downturn.

The Census Bureau reports that while every other major category of retail spending declined, nonstore retail sales rose by 9.5% in April and by 9.0% in May. Nonstore’s share of total retail sales jumped to 19.2% from 15.0% in April, illustrating e-commerce’s prominence during the pandemic. Although this share fell slightly in May when many traditional retail stores reopened, it remained considerably higher than before the pandemic.

Figure 1: Online Sales Metrics | % of Total Retail Sales & Food Services

In its Q1 2020 forecast, CBRE EA assumes that much of the gain in e-commerce’s share will remain in the post-pandemic economy and online shopping will continue to gain additional share at a more normal pace. This has important implications for industrial real estate demand over the long-term and will contribute to strong absorption.

Figure 2: Industrial Rent Forecast

Source: CBRE.com